The European online businesses are in pain. The upcoming Value Added Tax (VAT) changes are a nightmare and many European bloggers are crying out – but American bloggers are silent.

Why?

Because as soon as you open your mouth and admit that you know about the changes, you can no longer apply the default strategy to cope with this – by staying under the radar and ignoring the whole thing.

But there are questions you’d probably like answers to, like:

“What’ll happen if I ignore the changes?”

“How will this be enforced?”

“What’s the penalty for breaking the rules?”

“Are there any loopholes?”

It’s been a long time since I did accounting and taxes myself, so I interviewed a tax specialist and asked these questions for you.

DISCLAIMER: I cannot encourage you to illegal acts. The purpose of this post is to deliver information.

My official advice is to comply with the rules and do your duty as a tax-payer.

I’m describing the situation as it is now, so if you are reading this after Jan 1st 2015, some of the information may be outdated.

What’s changing and why?

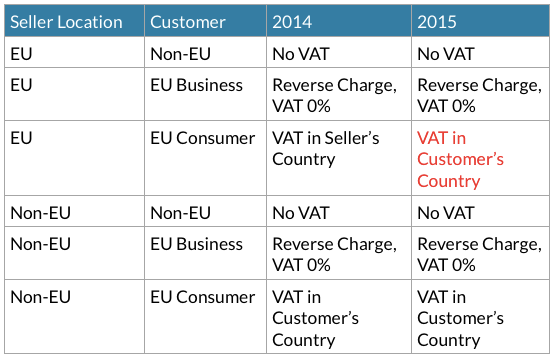

Until now European businesses selling to digital goods and services to European consumers have charged VAT based on where their business is located. Now the VAT must be charged based on where the consumer of the service/goods is located.

The change was made because EU wants to get more money from transactions for American companies – or to force them to move more operations to EU to get VAT reductions.

The VAT percentage is different country-by-country, ranging from 3% to 25%. Here’s a full listing of VAT rates in different EU countries.

The lowest rates are in Luxembourg, so that’s where Google, Amazon, Apple and other large American companies have their European headquarters. It’s been a perfectly legal strategy to pay less taxes – but after the change it will stop working. It no longer matters where your business is, the taxes will get paid based on where the consumer is.

What happens to small online businesses is just collateral damage.

What’ll happen if I ignore the changes?

If you take a look at the table above, you’ll notice that this change affects only EU businesses. The same rule has been active in Non-EU countries already since 2003.

So in theory you can’t start ignoring this – you’ve already done so for over 10 years.

How is the law enforced?

Currently each individual EU country enforces the law themselves, via tax audits.

VAT is an ‘end-user-tax’ so EU companies get to reduce any VAT they have paid, which is why their book-keeping has all the information tax authorities need.

Consumers don’t keep books on their VAT purchases. Consumers do get tax reductions from certain goods, so they’ll save the receipts and send them to tax authorities. Most of those are physical goods like work clothing, but there are also some goods that could be digital, e.g. work literature.

However, there are small businesses which aren’t registered for VAT yet. They may keep books already, yet they are categorized as a consumer by this law. As a rule, if an EU company cannot provide you a VAT code, they are a consumer. Yet they’ll keep books, save all receipts and are a target to tax audits.

There’s also a separate enforcement system. You must register as a VAT payer in each of the countries where you have consumer sales. Another option is to register to VAT on eServices (VOES) system in one EU country. VOES is a similar system than MOSS (UK), but for non-EU businesses. Each country has their own system, but it’s enough to register just in one country.

When you are registered, the authorities can then follow up that you send the reports and payments on a regular interval.

But if you aren’t registered, there’s very little enforcement.

To really enforce the law in the US, EU would need help from the US tax authorities. At the moment US tax authorities show little interest in enforcing this – moving wealth from US to EU isn’t in their best interest.

However, there have been some rumors on EU tax authorities starting to use spiders and web bots to find law-breakers, but whether these exist is unclear. There’s some information about this in Taxamo blog, but their material seems to be a bit biased to increase sales.

What’s the penalty for breaking the rules?

Frankly, the rules are so complex and change all the time that EU businesses break the rules accidentally every now and then.

When you break the rules accidentally or just because you didn’t know, what normally happens is that the tax authorities calculate how much tax you have due and charge it afterwards. In some countries like Finland you’ll also have to pay overdue payment.

If you break the rules intentionally, that’s a tax crime and a court gig.

However, each country in EU has their own law. Even though Finland does not have penalties, some other countries may have them.

Are there any loopholes?

Overall, the law is pretty clear this time. If there would be holes, they’d probably get plugged pretty fast. There’s only one gray area.

All kinds of digital goods and services are included. All kinds of physical and customized/human services and goods are excluded.

So in principle I could offer FirstOfficer.io for free, and then charge customers 1-2 times per year for support or metrics analyses – which are both manual work. I’ve also heard some speculations on automatically customizing ebooks, but the gist is in manual/human work, so I think that wouldn’t work.

It’s crazy, huh? What are you going to do?

If you ask me – YES it is crazy. There are 28 member states and over 75 different VAT rates – which I should all know and create different invoices for. And in principle you should too – since 2003.

Many small EU businesses are going to stop selling to European consumers, including me.

Starting from today, FirstOfficer.io SaaS analytics will continue to be available for all American customers, but European customers don’t get in without a VAT code. Most of my customers are from US so this doesn’t change things much for me, but it makes me sad.

Many small EU businesses with their own shops are going to have to move their business under the wings of Amazon, just because they can’t deal with the bureaucracy. There’s no revenue threshold in the VAT law, so we will lose all those lovely sewing patterns from handicraft shops and ebooks sold directly from people’s blogs. We might still be able to buy – but we’ll lose the personal shopping experience.

I can’t ask you to share this post – but please share this other VAT post for EU folks which links to the petition for the small online businesses. Because sharing is caring.

The post “I’m in the US – what if I just ignore the EU VAT changes?” appeared first on Happy Bootstrapper.