If you run an online business in EU, there are important VAT changes coming into effect at Jan 1st 2015. I met with a tax specialist to get an up-to-date view to what’s going on.

I wrote another blog post on how this change affects US-based folks, which also explains why this nightmare is happening, so I’ll concentrate on practical issues for EU-based businesses in this post.

TL;DR;

If the changes affect you, register to your country’s local MOSS-system NOW, before the year ends – it’ll save you a huge trouble later.

If the changes don’t affect you – please stand up and plead for the ones who are affected. Share this post, sign the petitions linked to the end of this post, take part in TwitterStorms, speak about this. We need a revenue threshold to this law to save the micro-businesses.

What’s going on?

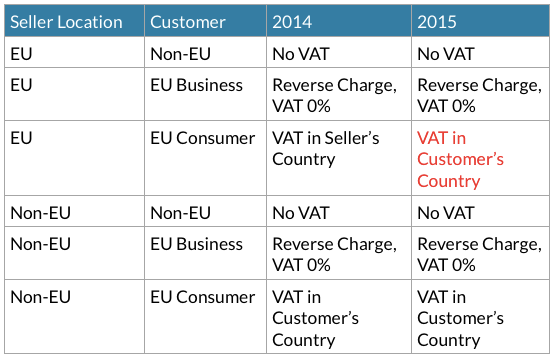

What happens is that consumer sales will carry a VAT based on the consumer’s location instead of the seller’s location. The change affects only digital goods and services, not products or services which are just delivered digitally.

Below is a table that shows the change in red:

Not only do you need to know the VAT rates for your goods in all the 28 EU member states – you’ll also need to create invoices and receipts to match. If you are using Stripe, I believe ecosystem apps like Quaderno are already working hard to make your life easier on this.

But even then, you’ll also need to handle the sales separately in your accounting and tax reports.

Until Jan 1st 2015, you can register to your country’s ‘Mini One Stop Shop’ (MOSS) system. You can report all your EU consumer sales through that system.

But if you miss the deadline, you’ll need to separately register for VAT in all the countries where you have consumer sales, because the MOSS system adds new users only once per quarter (at least here in Finland). And that means you’ll have to file VAT reports and make VAT payments to each of those countries separately. Yes, this sounds crazy, but this is what the tax specialist told me.

In addition to all reports, you must collect two proofs of the customer location. Country information from credit card, address or IP address would all do.

How do I know if this affects me?

If the goods/services you are selling aren’t digital, but are just sold online, this does not affect you.

For example, if you design web pages and each design is custom-made, the changes shouldn’t affect you. But if you sell web page templates instead, you are affected.

If you provide pre-recorded learning material via internet, the change applies to you. But if you provide live webinars, you can ignore the change.

How much human touch there must be in the process is still unclear.

If you aren’t the official seller, the change does not affect you either. So if you are an affiliate, or sell your goods via Amazon, you aren’t affected.

If you are selling only to businesses, the change does not affect you. You don’t need to register to MOSS either. The only thing you need to do is to collect the VAT codes from all of your customers and continue to use the reverse charge 0% VAT.

What is Reverse Charge?

Reverse charge moves the VAT-paying responsibility from you to your customer in another EU country. The responsibility can only be moved from business to business.

You’ll write an invoice/receipt without VAT (or 0% VAT) and include a text “Reverse charge, VAT directive art. 44” and you are done. In practice the text is often missing, as people re-use the same invoice format they use for non-EU sales.

Why do I need to collect the VAT code?

If your customer cannot provide a valid VAT code, they’ll be considered a consumer – no matter what kind of business they have.

In theory, you are responsible of validating the VAT codes you get. There’s a handy service where you can do that. If you get deceived and book VAT sales as non-VAT sales, your local tax authorities will calculate how much tax you have due and charge it afterwards. You’ll also have to pay overdue payment.

In practice, I wouldn’t worry about the validation part too much. Giving an invalid VAT code when you don’t have one is a tax crime, resulting an extra fees that can be thousands of euros, having to pay the tax that you’ve avoided – and you’ll end up in the court too. So smart people don’t give invalid codes just to be able to buy stuff.

How will small businesses handle this?

Now we are getting to the core of the problem.

Here’s what I’ll do. Starting from today, FirstOfficer.io SaaS analytics will continue to be available for all American customers, but European customers don’t get in without a VAT code. Most of my customers are from US so this doesn’t change things much for me, but it makes me sad.

This is the only logical thing to do for a mainly B2B product like mine.

If you can’t do that, Rachel has written several good articles on VAT and how they are going to handle it for their SaaS which is a bit more B2C. ArcticStartup has a good article about VAT as well.

But lots of small online shops are just going to drop the digital products, if that’s not their main business. Some businesses are going to change back to physical products from the digital ones, and many of them will move to Amazon or some other marketplace that makes them legally non-sellers.

What I can do to help?

Please stand up and petition for the small ones!

Your grandmother selling sewing patterns will become a law-breaker when the year changes. We’ll see a lots of content just disappearing from online shops or becoming unavailable to us.

I enjoy visiting the colorful and quirky small online shops by hobbyists who want to earn money doing what they love. Many of these shops can’t handle the extra workload and costs of the VAT change. I may still be able to buy the same things – but shopping experience in Amazon isn’t the same than visiting the small shops.

This isn’t right. Killing small online consumer shops in EU or making them criminal overnight just cannot be in EU’s best interest. We need a revenue threshold to this law to save the small businesses.

So stand up, speak about this, share this post, take part in TwitterStorms and sign the petitions below to save our unique small business shopping experiences:

The post EU VAT changes for online businesses – Act before Jan 1st! appeared first on Happy Bootstrapper.