Finding out how your recurring business is doing isn’t always easy. There are just so many mistakes you can do.

It’s easy to miscalculate the metrics – even some commercial SaaS dashboards do.

You can also err by tracking vanity metrics instead of relevant metrics. Fortunately there are lots of articles on what metrics you should track, including my SaaS Metrics for Hackers.

And then you can interpret the metrics wrong. Today I’ll present you the 3 simple interpretation mistakes that you can avoid just by knowing about them.

1. Compare Conversion Rate to Churn Rate

Business growth stops when more revenue is lost with churned customers than you get from new customers. That’s why people have the inclination to put the churn rate and the conversion rate side by side and compare them.

But you can only compare rates when they are calculated from the same baseline, which isn’t the case here.

Conversion rate is calculated using potential customers as its baseline. Churn is calculated using existing customers who are able to churn as its baseline. These two rates are not comparable with each other.

Growth rate can’t be compared to churn rate either, for the same reason, but the mistake is smaller there.

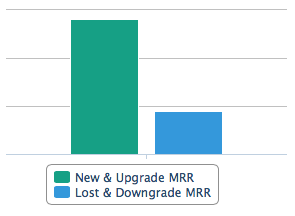

One way to find out if you are approaching a plateau is to compare the actual MRR components. When the Lost & Downgrade MRR gets as big as New & Upgrade MRR, growth has stopped.

The screenshot is from our upcoming analytics tool.

Another good way is to calculate Growth Ceiling.

2. Confuse Revenue with Profit

Dan Norris recently revealed how he ruined his business profitability. The mistake he made? He concentrated only on revenue.

It doesn’t matter how much you charge – it only matters how much of it you get to keep after you have paid the bills and the taxes.

This shouldn’t be applied only to revenue, but to all the key metrics using revenue as their base.

Customer Life-Time Value (CLTV) should be calculated from profit, but nowadays it’s often calculated from revenue. You don’t want to use 1/3 of the revenue from a single customer to his acquisition. But you may want to use 1/3 of the profit to the acquisition, if you can recover that money fast enough.

If you are using CLTV and you didn’t calculate it yourself, find out if it’s calculated from revenue or from profit. You can then multiply the CLTV (revenue) by your gross profit margin, and get the ‘real CLTV’.

3. Confuse MRR with Cash Inflow (or Sales, or Bookings or Revenue)

I found this mistake in Christoph’s 9 Worst Practices in SaaS Metrics presentation.

Monthly Recurring Revenue (MRR) shows you the momentum of your business. You can use it to calculate CLTV and other metrics that need to stay stable from month to month.

You can’t use it e.g to calculate your profit. It’s just not accurate enough. It’s normalized to remove any fluctuations.

MRR matches to your real revenue only if all your customers arrive on the first day of every month, you don’t give any discounts or refunds, don’t have metered charging and only sell subscriptions.

SaaSOptics has an excellent but lengthy explanation on how MRR differs from GAAP revenue (the real revenue earned).

The post 3 Ways to Misinterpret SaaS Metrics appeared first on Happy Bootstrapper.