Staying on budget is sometimes hard when you run a SaaS. The money in your business account is a combination of old revenue, current month’s revenue and annual pre-payment revenue happily mixed up with any other revenue your business might have.

The last couple of weeks I’ve come up with ways to use SaaS metrics to solve common challenges, like the one above. I’ve done the work for Virtual Financial Officer, but why not share the principles so that you can use them too.

In this post I’m going to explain how a little change to how you calculate your Monthly Recurring Revenue (MRR) can help you to understand your future cash-flow better.

Meet Deferred MRR

I call this new metric “non-GAAP deferred revenue” or “deferred MRR” (I just made up both names).

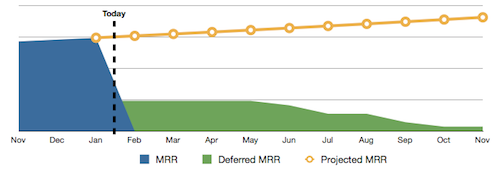

Deferred MRR shows the part of the future MRR you have already received as pre-payments, allocated to the months where you’ll have to deliver the service to your customers.

During those months you’ll be paying the server bills, providing customer service and everything that these customers need – while not getting any more money from them.

Image may be NSFW.

Clik here to view.

(No MRR should be visible in the future, but iWork Numbers just didn’t co-operate with me on that, sorry)

What’s deferred MRR good for?

If you compare deferred MRRs to your projected MRRs, the difference shows approximately how much subscription money should be landing to your bank account in the future months.

That way it’s easy to see if you need to save, or if the revenue coming from your monthly paying customers will cover the costs.

You can also sum up all the deferred MRR and then you can go:

“The profit and loss statement from the first two months says we are $25,000 on the plus side, but $18,000 of that is actually annual pre-payment revenue. So the actual profit by now is just $7,000 and we aren’t reaching our targets…”

The sum of deferred MRR is also the amount that you would need to return to your customers if you would close the shop today.

What larger companies do…

Large SaaS companies solve these same cash-flow challenges by using accrual-basis accounting instead of cash-basis accounting. Their monthly bookkeeping reports actually show a line for deferred revenue – the revenue from services that they have not delivered yet.

That deferred revenue should not be mixed up with the one we calculate here. Those are 2 different metrics, the deferred revenue that comes from accounting being more accurate.

This “non-GAAP deferred revenue” that we derive from MRR is accurate enough for budget and cash-flow follow-ups. As long as your new (annually paying) customers don’t arrive in big random bursts, the figures will be almost as good as you’d get from accrual accounting.

Why not just use accrual-basis accounting?

Even though accrual-basis accounting is superior for business analysis purposes, small companies often don’t want to use it. If you aren’t money-savvy or if you have a lot of contracts where you provide the service first and get paid later, you may end up having problems in paying your taxes.

This article by Jason Cohen explains the pros and con’s of both accounting methods.

How to calculate deferred MRR

Normally, when you calculate MRR you handle annual subscriptions like this: You take the number of customers who are on the annual plan and you multiply them by the part of the plan revenue that belongs to the current month.

For example, you have 10 customers on your annual plan that costs $240. That’s $20 per month per customer ($240/12=$20). So these customers will get you $200 of MRR (10*$20=$200).

If you want to keep track of your deferred MRR, all you have to change is to account that money to the months where you’ll be actually earning it.

So if your customer paid $240 in January 15th, you’d put $20 to January, $20 to February and so on, ending with $20 in December.

This, of course, may be too much work if you are working with spreadsheets. But if you have your own dashboard system, it works brilliantly.

Any MRR that’s accounted to the future is deferred MRR. And next month, you’ll only have to account for the newcomers, as the pre-paid MRR from existing customers is already there.

Also remember that you’ll have use the same system for refunds that you give to annual customers.

How to transition to using this?

Unless you can re-process old annual transactions, your figures will exclude all the annual revenue charged before you took this new system into use, and that will not do.

If you can re-process old transactions, you can just plug in the new formula and let your system recalculate your MRR from all time and you’re done.

If you can’t re-process old transactions, you can use both systems side by side and ignore the figures from the new system until the MRRs from both systems match. If your longest pre-payment period is a year, it will take a year.

But you are using Stripe you can just wait until we get our app ready.

The post Kill SaaS cash-flow problems with this small calculation trick appeared first on Happy Bootstrapper.