When I first found out how most bootstrappers calculate customer life-time value I went “OMG! Value means profit – net profit! Not revenue! Aargh! You are crippling your most important profitability metric! Are you trying to shoot yourself in the foot?! ”

Later, I learned that small SaaS businesses (Annual Recurring Revenue < 1MM) have their own special characteristics – high profit margins and churn rates. Those characteristics allow them to safely use the simple revenue-based LTV formula and skip the discount rates.

The most common ways to calculate customer lifetime value (abbreviated CLTV, LTV or CLV) are:

- CLTV as estimated future customer life-time revenue

- CLTV as revenue after cost of service (revenue * gross profit margin percentage)

- CLTV as net profit, resource usage or activity based costing

It’s smart to use simplified formulas, but only if you do it by intention, not by accident.

Only use revenue-based LTV if you have super-high profit margins

One of the characteristics of small SaaS businesses is that they may have very high profit margins (gross profit 85-95%). They don’t have employees and the founders often don’t properly account for their own working hours. When that’s the case, it’s ok to use the revenue-based LTV formula.

You can use this LTV to estimate the maximum customer acquisition cost (CAC) and the amount of discounts you can give to your customer. Just remember that the LTV after CAC/discounts must be big enough to pay your bills and your salary.

You can’t safely scale your business using revenue-based LTV

It’s often said that when your CAC is smaller than your LTV, you have a money-making machine, ready for scaling – just pour in the money.

But that doesn’t work with revenue-based LTV – because the costs are not counted in.

The revenue-based LTV doesn’t present a scaleable model of your business.

Just think about it… how much would it cost if you hired someone to do all that customer support, marketing and implementation work you do and don’t account for? When you scale, that workload will scale too – and there’s only one you to go around. And none of that cost is visible in your calculations.

Also, different customer segments often have different profitability – and you can’t access that information without a more complex LTV formula.

The (gross profit) CoS-based model isn’t enough

When you start to include costs to the LTV, the most common way is to use gross profit margin percentage to calculate how much of the revenue you’ll get to keep after costs (CoS = Cost of Service).

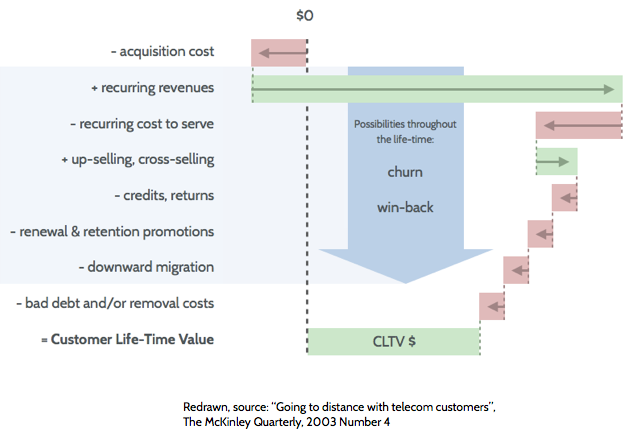

The picture below illustrates the factors that should be taken into account when calculating the gross profit based LTV. Done right, activity-based costing should be used to target the costs to the correct customers/segments. In practice, people just use the gross profit margin percentage.

Image may be NSFW.

Clik here to view.

But if SaaS is your only product then your customers should not only cover the cost of the service – they should cover the cost of everything. And part of the costs you didn’t include in your calculations are costs that will scale along with the customer count, like premises for your employees. They just don’t scale linearly.

If you don’t account for all costs, you may end up in situation where you can’t serve your new customer base with your current resources. Since the profitability in general is good with SaaS, the risk is small. But it’s there.

Calculating the CLTV with costs is more complex, but even the simpler gross margin-based formulas decreases your business risk a lot and is worth the extra trouble.

Only skip the discount rate if your churn is high

Originally, the customer lifetimes used in LTV calculations were +10 years. SaaS, even with recommended churn rates, most often have customer lifetimes of 5-10 years. And small low-touch SaaS often have even shorter customer lifetimes.

When your customer lifetime is short, it doesn’t matter if you get the money today or later. You can safely skip the discount rate in the calculations.

Remember to swap the formulas as your business grows

Using the formulas that are as simple as possible is smart and effective.

But it’s good to check the used formulas every now and then to make sure your calculations are still accurate enough for your needs.

The post Using a wrong LTV formula can kill your profitability appeared first on Happy Bootstrapper.